From the Middle East Report issue 251 of Summer 09

written by Christopher M. Davidson, a senior lecturer in the School of Government and International Aff airs at Durham University. Mr Davidson is the author of Dubai: The Vulnerability of Success

(Columbia University Press, 2008).

=================================

Glitzy Dubai, long considered the new Monte Carlo or the Las Vegas of the Middle East, has suffered one of the worst crash landings of this global recession. Dubai might be considered a bellwether of the global credit crunch. Until recently touted as a beacon of progress in an otherwise unstable region, the tiny emirate’s seemingly innovative economic and political model is now unravelling, with no end in sight to the uninterrupted stream of bad news. Construction has ground to a shuddering halt, unemployment is rising, sovereign debt is exposed, lawsuits are being prepared, and the population is decreasing, as those who moved to Dubai in search of a better life have either lost their jobs or are cutting their losses and leaving.

To make matters worse, as the city empties itself out, traffic thins, and cars and credit cards are abandoned at the airport, the embattled authorities have embroiled themselves in fresh controversies by introducing protectionist policies for their citizens and a new media law that forbids criticism of the economy, and earning Dubai an anti-Semitic branding in the sports world by denying a visa to an Israeli athlete. With investor confidence in tatters and debt repayments looming, its humiliated rulers have had little choice but to turn to their wealthier neighbors. But although help has finally arrived, it is by no means the lifeline that the emirate really needs, and Dubai’s future hangs in the balance.

The Dubai ModelThe story of the Dubai business model really begins in the mid-1990s. With oil exports having peaked at about 400,000 barrels a day, the four sons of the late Sheikh Rashid bin Said al-Maktum were committed to building a diverse, multisector economy to reduce their dependency on hydrocarbons and exposure to the vagaries of the international oil markets. If such diversification did not take place, it was understood that the emirate would eventually lose its economic autonomy and, by extension, its political autonomy within the seven-member United Arab Emirates (UAE). Dubai’s new post-oil economy capitalized on its long history of trade, merchant immigration and re-export activity, and its relative openness compared to its Arab peninsular neighbors. With its low taxes and strong regional contacts, Dubai hoped to reprise its role as the region’s premier entrepôt and go global with its brand of economic liberalization.

Crown Prince Sheikh Muhammad bin Rashid al-Maktum took charge of the situation. Supported by Maktum, his eldest brother and Dubai’s nominal ruler, he forged ahead with the emirate’s “free zone” policies. In the late 1990s, Muhammad’s strategy involved expanding the original Jebel Ali industrial zone where foreign companies could enjoy 100 percent ownership, and establishing several new free zones. Jebel Ali soon mushroomed to over 2,000 companies, many of which were European and North American. By 2001, a plethora of high-profile multinationals and other foreign companies, including Microsoft, Dell, Reuters and the BBC, were locating themselves in Muhammad’s new Dubai Internet City and Dubai Media City. Dubai effectively became the Middle Eastern headquarters of these big global economic players. Since then, many other free zones have opened, including entire “villages” for branch campuses of foreign universities and health clinics, and even a Dubai International Financial Centre that operates under English common law and attempts to bridge the time zones of European and Asian stock exchanges.

Dubai was also committed to building up a luxury international tourist industry. The Jumeirah International Group, established in 1997, was responsible for building a number of iconic resorts, including the Jumeirah Beach Hotel and the Burj al-Arab—the world’s only seven-star hotel. So strong was the emphasis on high end tourism that in the late 1990s, it was estimated that ten percent of GDP was spent on developing this sector. By 2008, with hundreds of hotels, including several dozen with five stars, the emirate was hosting over six million tourists a year. Backed by a successful airline, two annual shopping festivals, and a host of international sporting and music events, the number of tourists was predicted to climb to ten million or more by 2012.

To attract investment from wealthy individuals, a real estate sector was introduced in the late 1990s. Although somewhat controversial, given that it was against UAE law for foreigners to own property, Sheikh Muhammad bypassed this complication by initially allowing foreigners to buy renewable 99-year leases. Real estate accelerated when the Nakheel property company constructed two separate “Palm Islands” off the coast of Jumeirah and Jebel Ali featuring villas, apartments and, in cooperation with the Trump Organization and the Taj Group, several five-star hotels. These giant patches of reclaimed land expanded Dubai’s waterfront from about 70 to over 500 kilometers, given that each “palm” has several fronds and a number of additional exclusive mini-islands in the shape of Arabic lettering to represent one of Muhammad’s most well-known poems. In 2004, when both palms sold out, Muhammad instructed Nakheel to launch a third palm island and another archipelago further out at sea.

Following the death of his elder brother and his formal installation as ruler of Dubai in early 2006, Sheikh Muhammad decreed that foreigners could own real estate in “some parts of Dubai, as designated by the ruler,” and would be entitled to residency visas from the Dubai government, thus altering the previous rule restricting residency visas to those with proof of employment. To further alleviate investors’ risk-averse concerns, a law was passed establishing a Lands Department that would provide a centralized registry capable of issuing deeds. Demand for Dubai’s real estate projects soared, and additional developments were launched. In some cases, demand was so high that prospective customers were advised to arrive at sales centers on the morning of the launch in order to line up for lottery-like tickets that would entitle them to make a purchase. Emaar Properties, which became a 67 percent publicly owned company following its flotation on the Dubai stock exchange, pressed ahead with its magnificent Burj Dubai: a mixed residential, commercial and hotel complex boasting some 165 or more storeys and a dynamic design to be the world’s tallest structure.

By the summer of 2008, Dubai, on paper at least, had succeeded in diversifying its economy. With the non-oil sectors accounting for more than 95 percent of the emirate’s GDP, the hydrocarbon industry was pushed further into the background. An estimated $3 billion in annual foreign direct investment flows underscored Dubai’s reputation as the most vibrant economy in the region, and UN reports ranked the emirate as the seventeenth most attractive economy in the world for foreign investment. The free zones were booming, the hotels were full, and the city’s population had reached two million. Mega real estate projects were being announced on a weekly basis and the three biggest developers were estimated to have produced in excess of 30,000 new homes. By conservative estimates, investors were enjoying annual returns of over 20 percent on their deposits for houses or apartments, while some were “flipping” on their deposits within months for handsome profits.

Enter the Credit CrunchIn September 2008, with the credit crunch entering its second year, Dubai appeared to have been spared the toxicity spreading throughout economies in the West. New York Magazine claimed that Wall Street bankers were decamping by the dozens to Dubai which, if anything, was growing faster than before. Delegates in Kuwait’s parliament complained that even without oil Dubai’s economy was doing better than theirs. Sheikh Muhammad was hailed as a visionary ruler across the Arab world, and in some cases far beyond. From Dubai’s side the message was equally loud and clear: Dubai was circumventing the global economic tsunami. In early October at Cityscape 2008, the emirate’s premier real estate convention, plans for a one kilometer-tall tower were announced, even as the Burj Dubai stood unfinished. Jumeirah Gardens and Waterfront City, projects that would lead to a new residential area the size of Manhattan Island, were being promoted aggressively. In November, as perhaps the ultimate Bonfire of the Vanities, a $15 million party was staged at the brand new Atlantis Hotel. With hours of firework displays and guest appearances from A-list Hollywood celebrities, the launching of the $800-a-night resort on the outer edge of the Jumeirah Palm Island was a clear signal that Dubai was bucking the trend, and doing so with considerable panache.

Behind the glamor, however, the rot had begun to set in. Foreign investors’ interest in real estate was declining markedly and hotel occupancy rates began to falter as tourists turned to cheaper destinations. Most seriously, Dubai’s banks and mortgage lenders were struggling to find credit on the international market. Loans dried up, speculators began to disappear, and the first major wave of resale properties began to hit the classifieds as nervous expatriates sought to cut their losses and run. The confidence bubble was pricked and the Dubai stock markets went into free fall, with share prices for erstwhile government-backed blue-chips such as Emaar Properties shedding over 80 percent of their value by December. The two biggest mortgage lenders, Tamweel and Amlak, had to be merged under a new federal authority.

A strenuous chorus of defense and denial began, led by the authorities and joined by stakeholders in the Dubai model, including expatriates who had put their entire life savings into real estate. Academics, think tank professionals, bloggers and domestic newspaper editors—none of whom had identified shortcomings in the Dubai model, let alone predicted the crash—contributed to a stream of articles and opinion editorials claiming that the emirate’s economic fundamentals were perfectly sound, and some went so far as to state that Dubai was the safest place to anchor in the global crisis.

The Bubble BurstsBy the end of 2008, the doomsday indicators had increased: Hundreds of cranes stood motionless over incomplete projects, employee firings were rising, fewer lights were shining from the windows of tower blocks at night, and—refreshingly for some—Dubai’s infamous traffic jams were easing up. Legions of laborers were sitting idle in their camps, and a string of high profile suspensions and cancellations were tersely announced, including the short-lived Jumeirah Gardens and Dubailand, the emirate’s much vaunted Disneyland-sized theme park. Sensing that the international spotlight was beaming in, the government came clean and declared that it had accumulated a giant debt of $80 billion or more, most of which was due for reservicing over the next few years. To allay fears, officials stated that Dubai’s sovereign wealth, estimated at some $85 billion, would be enough to cover this.

But such claims were greeted with skepticism because the international media was reporting that much of the sovereign wealth was either inaccessible or had been eroded significantly by recessions in recipient economies. The major ratings agencies, including Moody’s, downgraded Dubai’s banks, and by February 2009 the emirate’s credit default swaps had rocketed to Icelandic levels. Expatriates, investors and tourists continued to vote with their feet as thousands of exit visas were being processed each day. Hotels engaged in a price war, slashing room rates by over 70 percent. Newspapers, bulletin boards and blogs groaned under the weight of hastily produced property advertisements, some of which threw in all furniture and fittings. For those laborers whose employers were no longer in business, hundreds were being rounded up each evening and bussed to the airport.

Dubai’s Descent

This economic collapse was taking place against an increasingly unpleasant backdrop of corruption, authoritarianism and protectionism. With investors seeking their money back, pyramid schemes that had been unchecked over the years were being exposed. Foreign investigative journalists reported on expatriate real estate developers who were being held without charge, and even companies backed by senior members of the ruling family were coming under scrutiny. Column space in domestic newspapers began to be handed over to the Dubai chief of police who, oddly perhaps, briefly became the government’s primary spokesperson for economic matters. He has blamed the crisis on greed (rather than a lack of regulatory infrastructure or sound economic planning) and has refuted foreign journalists’ accounts of the crisis. Other government spokespeople have claimed that negative reporting is evidence of an international conspiracy to undermine Dubai’s success.

New legislation was introduced at the federal level, seemingly at Dubai’s behest, that formalizes the protection of UAE nationals in their jobs. This, together with the circulation of a draft media law that would prohibit criticism of the economy (under which journalists could be fined up to $270,000), has sent out a fresh wave of signals that Dubai’s liberalization was distinctly fair weather. With the economic downturn, the political system is unable to adjust to the new realities. Perhaps the clearest example of the emirate’s liberal retrenchment was its denial of an entry visa to an Israeli tennis player who had been scheduled to compete in Dubai’s international tournament. The Women’s Tennis Association fined the Dubai organizers, which led to the withdrawal of the event’s major sponsor, the Wall Street Journal, and prompted the main US tennis television channel to boycott the event.

By the end of February, Dubai was effectively bankrupt as it struggled to service even the first of 2009’s major debt renewals. The Dubai stock exchange, which had earlier taken out loans to buy the Norwegian stock exchange, OMX, needed to refinance $3.8 billion of debt. A last-minute deal was reported in the domestic press as proof that Dubai could keep going, but it soon became apparent that only $2.5 billion of credit had been acquired on the international market, and that other Dubai entities had had to step in to make up for the shortfall. Rumors resurfaced that the emirate would have no option but to seek assistance from oil-rich Abu Dhabi, no matter how unpalatable such a move might be. Up to this point, Abu Dhabi had remained aloof from Dubai’s problems, having only injected $19 billion of liquidity into federal entities in November 2008, and in February having only guaranteed banks in Abu Dhabi, rather than across the whole of the UAE.

The Big Bailout

On February 25, a brief notice was posted by a Dubai government department that the UAE Central Bank, of which Abu Dhabi is the major stakeholder, had bought into a $10 billion five-year bond for Dubai. With interest rates set at four percent, this was a lifeline for Dubai, as the emirate had little chance of acquiring such credit elsewhere. Although not technically a bailout, Abu Dhabi had devised an unsubtle means of channelling aid to its beleaguered neighbor and thereby avoiding, or at least delaying, a complete meltdown of the Dubai economy. In many ways, Abu Dhabi can now dictate terms to Dubai, and will almost certainly seek to centralize the federation and rein in Dubai’s autonomy. But given the political culture of the Gulf states, this is likely to be as discreet as possible and will allow the Dubai ruling family to save at least some face. Nonetheless, just seven weeks after the bond was issued, the ruler of Abu Dhabi made a personal visit to Sheikh Muhammad’s palace and took an “inspection tour” of Dubai’s projects.

Abu Dhabi’s primary concern is unlikely to be the Dubai business model, but rather Dubai’s close relationship with its major trading partner, Iran. With Iran-Dubai trade having reached $14 billion in 2008, the emirate was understandably reluctant to align itself with Abu Dhabi and the United States in their efforts to isolate the Iranian economy. With the announced closure in early March of Dubai’s creekside jetties, most of which service dhows laden with goods destined for Iran, this may be Abu Dhabi’s first step of many in severing this worrisome link.

As yet, it is unclear how the Dubai model’s epitaph will read. The emirate’s debt continues to grow and Abu Dhabi’s influence can only continue to increase. Even if it weathers the global recession, the Dubai that emerges at the end of the storm will be a shadow of its former, fiercely autonomous self. Some may argue that Dubai has been in debt before, and has bounced back before. But in the past its debt has always been used to finance useful physical infrastructure, such as ports, airports, dry docks and bridges, most of which ultimately enhanced its traditional role as an attractive regional entrepôt. In contrast, the debts of the new economy have been used to build up sectors that have aimed to bring money to Dubai and keep it there, rather than allowing Dubai to serve as an interlocutor. This has allowed a distinctly unsustainable “moonbase economy” to form on the edge of a desert. Exacerbating the situation, the massive, unchecked influx of expatriates during the boom years has created an enormous demographic imbalance. Their departure will leave deep holes in the economy: unlike a recession in a developed country where redundancies will leave workers on the sidelines, in Dubai they have to leave

within a month as their residency visas expire. Their contributions to the domestic economy promptly cease, and the vicious circle continues.

With the benefit of hindsight, the Dubai model planners and visionaries must now realize that real estate, luxury tourism and a construction industry should never have been allowed to become central pillars of the economy. All were reliant on an uninterrupted stream of foreign direct investment and a perpetually favorable international credit climate. Little was done to slow the rampant speculation, and regulations were either insufficient or were introduced too late. No effort was made to build a knowledge economy as higher education remained little more than an economic sector, and no moratorium was placed on real estate projects, leading to a massive glut. Without longer-term visas or a road map towards citizenship status for real estate investors, Dubai also did little to engender loyalty. Perhaps the most incredible aspect of the Dubai crash was how quickly it happened: within weeks of the credit crunch hitting the Gulf, the emirate’s economy began to freeze up, and within months the coffers were empty. With no obvious “Plan B” and barely any contingency funding, the “Dubai vision” was never more than a giant gamble, most of it with other people’s money.

From 27th July 09 edition of Fox News' The Live Desk.

From 27th July 09 edition of Fox News' The Live Desk. From 27th July 09 edition of Fox News' The Live Desk.

From 27th July 09 edition of Fox News' The Live Desk.

This is shaping up to be an enthralling, and very public, brawl. As a commenter on an earlier posting pointed out, this matter will be open to public gaze once it starts to process through the Australian Courts. If the Court case captures the public imagination, as it no doubt will, it will take on a life of its own. No matter what the eventual outcome, Dubai's reputation, in Australia at least, will be severely damaged, mud will be slung and some of its going to stick.

This is shaping up to be an enthralling, and very public, brawl. As a commenter on an earlier posting pointed out, this matter will be open to public gaze once it starts to process through the Australian Courts. If the Court case captures the public imagination, as it no doubt will, it will take on a life of its own. No matter what the eventual outcome, Dubai's reputation, in Australia at least, will be severely damaged, mud will be slung and some of its going to stick.

An extract from an article in GoldCoast.com.au. The rest of the article has the same content as quoted in an earlier posting. This piece gives a bit more information on the local connection in the UAE.

An extract from an article in GoldCoast.com.au. The rest of the article has the same content as quoted in an earlier posting. This piece gives a bit more information on the local connection in the UAE.

Sheikh Khalid Al Qassimi (photo http://www.rallye-info.com/)

Sheikh Khalid Al Qassimi (photo http://www.rallye-info.com/)

A merger between Dubai's Emaar Properties and three local firms is likely to be more distressing than supportive due to strategy uncertainty and exposure to the suffering property sector, EFG-Hermes said.

A merger between Dubai's Emaar Properties and three local firms is likely to be more distressing than supportive due to strategy uncertainty and exposure to the suffering property sector, EFG-Hermes said. From The National 1 July 09

From The National 1 July 09

Photo courtesy of Demotix

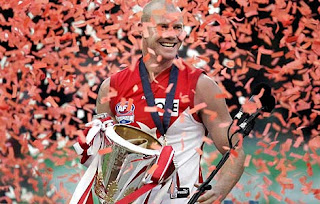

Photo courtesy of Demotix Sydney forward Barry Hall has announced he is quitting the Swans AFL club, effective immediately.

Sydney forward Barry Hall has announced he is quitting the Swans AFL club, effective immediately.