This is how the Sydney Morning Herald website looks at the moment, its been coming up in this weird format for the past week or so. Does anyone know why? Sometimes after 5 minutes it organises itself into the proper format but usually not.

This is how the Sydney Morning Herald website looks at the moment, its been coming up in this weird format for the past week or so. Does anyone know why? Sometimes after 5 minutes it organises itself into the proper format but usually not.

There's no such thing as a dangerous high speed chase in Qatar, everyone drives like that.

Thursday, 26 February 2009

Weirdness on the Web

This is how the Sydney Morning Herald website looks at the moment, its been coming up in this weird format for the past week or so. Does anyone know why? Sometimes after 5 minutes it organises itself into the proper format but usually not.

This is how the Sydney Morning Herald website looks at the moment, its been coming up in this weird format for the past week or so. Does anyone know why? Sometimes after 5 minutes it organises itself into the proper format but usually not.

Monday, 23 February 2009

Beehives and borders

Last weekend we headed to Oman with our friends Allen and Carolyn to see the beehive tombs at Al Jaylah. The first stop on Thursday night was the Ibri Hotel, home of the finest chips (French fries) in the Middle East. While the Ibri Hotel doesn’t pretend to be flash, its clean, secure and they do two important things well; (1) the bed is always comfortable and (2) the shower has reasonable water pressure plus the added benefit that you don’t need a PhD in hydranautics to operate it.

On Friday morning we drove from Ibri to Ibra, a trip of 3.5 hours. After a break for lunch we headed up into the Hajar Mountains to the Shir plateau in search of the Burooj Kibaykib-Al Jaylah tombs. On the drive up we followed the directions from the Omani government booklet on the area, they were pretty good, except some parts of the road had been washed out by Cyclone Gonu and the road position had changed since the book was published. The GPS came into its own again from that point.

We reached the top of the climb and as the road leveled out, in the distance the tombs could be seen rising out of the rocky plateau. They're awesome, these tall, stone towers standing like silent guardians over the broad, arid landscape. Sorry, I should have given a "flowery prose alert" shouldn't I? The tombs are of two types all built from the local rock. There are the large cylindrical towers some up to 5 metres high and then there are smaller Hafit/Umm al Narr tombs. The smaller tombs are thought to be part of a network as they have been found at several other places in Oman dotted along what were once trade routes. The tombs at Al Jaylah are believed to be 4,000 years old and while the local people knew of their existence, they were only ‘discovered’ by the West in the 1990s when an archaeologist looking through a book of aerial photos of Oman spotted the telltale shapes. The first archaeological expedition was mounted in 1991 and eventually 90 tombs were found in the area. In 1994 one of the tombs was opened and skeletal remains, beads and pottery fragments dating from the early Iron Age were found inside. Local legend has it that the towers were built by a man named Kibaykib who was half man-half jinn (spirit). I won’t go into the whole story, suffice to say its fairly gruesome and involves dark caves, dark deeds and a thunderbolt.

The plateau on which the tombs stand is 2,000 metres above sea level and until the 1970s, when contact was made by the authorities with the local tribespeople, was regarded as one of the most remote and inaccessible parts of Oman. Life there is hard, the climate one of the driest on earth with an average rainfall of only 75mm, fortunately there are small minor springs in the area to supply water. The local people are semi-nomadic relying on their herds of goats and sheep for survival. Its still wild up there too; a woman was attacked by a wolf in one of the local villages only a few years ago. The locals have had some surprise visitors though, in April 1987 a plane crashed on the plateau during a demonstration flight for the Abu Dhabi Defence Force. Luckily no injuries.

While the use of the tombs as burial places is without question, there is also the possibility that they served as markers on the ancient trade route from the Omani interior (the Sharkiya) to the port at Tiwi. The copper trade flourished in Oman in pre-Islamic times with rich copper deposits in the Shir area as you’ll see from some of the photos.

After spending several hours at the tombs we headed down to the coastal village of Tiwi on a road described in one of our guide books as “challenging”. This road is not for the faint hearted, clinging as it does to the side of the cliff with nothing between you and oblivion but the piles of dirt pushed aside by a grader. One hairpin bend in the road is so sharp and so steep that it has been concreted (no idea how) but even then the Prado’s wheels slipped around trying to make traction. How they stopped the wet concrete from running to the bottom is beyond me though. This is not a road where you’d ever want to meet someone coming the other way.

We spent the night in Muscat and the next day visited the Sultan's Armed Forces Museum in Ruwi. If you're ever in Muscat, I'd recommend a visit to this museum, the display of militaria is varied and interesting, there's a comprehensive display detailing Oman's history and development *and* you get your own soldier-guide.

That afternoon we headed back to Dubai travelling on the new highway that runs parallel to the coast road that took such a hammering in Cyclone Gonu crossing the border back into the UAE at Hatta. It was only recently that I learned that a 10 mile section of the main highway on the UAE side of the border just out of Hatta, is actually part of Oman. When you’re on the road itself, the only clue to this oddity might be seeing an Omani flag on one of the buildings in the distance. Otherwise, you’d think you were driving in the UAE but you’d actually have driven in, and out of, a little piece of Oman without realising it. (This is unless you are unfortunate enough to have a traffic accident somewhere on that part of the road and you didn’t have Omani insurance.) Normally nothing happens on this stretch of road but on Saturday evening we ground to a halt as the Omani police assisted by the Army, stopped all road traffic at both ends of “their” section of the highway. The traffic was queued up for quite some distance at both entry points but the police seemed to be only checking trucks as all the cars were being waved through. Hmmm, interesting!

A resource on the beehive tombs at Al Jaylah is here.

Sunday, 22 February 2009

The emirates set a good example in a bad neighborhood.

From the Wall Street Journal 20th February 2009

There's No Reason to Gloat Over Dubai's Fall by Zvika Krieger (a former correspondent for Newsweek in the Middle East, is an editor at the New Republic.)

Of all the victims of the global financial crisis, Dubai and its neighboring states are receiving little sympathy. The oil-rich Persian Gulf emirate, which until recently had been a glitzy boomtown attracting fortune-seekers from across the globe, is reported to be canceling 1,500 work visas every day. Its real-estate market has dropped 30% or more over the past few months.

Their indoor ski slopes have earned these sheikhdoms few friends. Los Angeles Times columnist Rosa Brooks shed no tears that "Dubai may be going down," finding it "hard not to be revolted" by a state that "doesn't really produce anything of value" but is a playground for "cold-eyed Russian oligarchs, coked-out London pop stars and the spoiled princelings of global finance." News reports have been dripping with schadenfreude. Newsweek recently bid "Goodbye, Dubai" on its cover, while Time wondered if the Gulf collapse means "no more Palm Islands?" In response to Dubai's decision to deny a visa to Israeli tennis player Shahar Pe'er, New York Times columnist Harvey Araton gloated, "Just like that, the glitter and promise of Dubai as an emerging international sports center evaporated into the cool desert night."

But it would be a mistake to dismiss Dubai, Abu Dhabi, Qatar and the other Gulf emirates as nouveau riche Bedouins on a petrodollar-fueled shopping spree. In a region mired in poverty and extremism, the Gulf emirates are shattering taboos and challenging traditional power structures. Their financial demise would be a great loss to the Middle East.

The Gulf emirates have become financial lifelines in the region, sustaining their less wealthy Arab neighbors through billions of dollars of direct investment, and providing tens of thousands of Arabs with jobs. Their free-zone model of development has been adopted in countries like Jordan and Saudi Arabia, and their tourism boom has overflowed into countries like Egypt and Syria. The Western businesses attracted to the Gulf are opening new markets across the region.

But the significance of the emirates goes beyond money. They have applied their pragmatic business strategies to diplomacy, using their financial independence and domestic stability to mediate disputes from Morocco to Libya to Yemen. Besting traditional regional powerhouses like Egypt and Saudi Arabia, Qatar was the only country that helped effectively mediate an end to Lebanon's violent conflict last year -- largely because it was the only country considered close enough to both Syria-backed Hezbollah and the Western-backed government to be trusted by both sides.

The recent controversy over Israeli tennis star Shahar Pe'er obscures the fact that Dubai and its neighbors are the only countries in the region (other than Egypt and Jordan) that have been willing to consistently violate the Arab League boycott of the Jewish state. Qatar opened an Israeli trade mission in 1995 and recently hosted Israeli Foreign Minister Tzipi Livni. Dubai has also allowed Israeli nationals to enter the emirate for conferences, and it is currently in high-level discussions to open an Israeli mission as well. In its discussions with New York University about its new satellite campus, Abu Dhabi has indicated a willingness to overrule visa restrictions relating to Israelis and signaled that it is re-evaluating the policy for all of the emirates. The negative attention garnered by the Pe'er decision will likely expedite this process.

The Gulf emirates are also revolutionizing education in the Middle East. Dubai is forming partnerships with institutions including NYU, Harvard, MIT and Cornell. While critics are right to be skeptical that these programs will measure up to their counterparts in America, they will certainly outperform the underfunded, overcrowded and censored universities that currently populate the region. These new institutions will bring Western ideas and high standards of education to Arabs across a region where traditional families are reluctant to send their children overseas for university, but are increasingly seeing the Gulf as a viable alternative.

Though there are still some restrictions on expression in the Gulf emirates, these states house some of the freest media in the region. Qatar's Al-Jazeera, the Arab world's most popular television channel, has broken the monopoly of state-controlled propaganda channels by featuring probing coverage on some of the region's most controversial topics. Abu Dhabi has pumped millions of dollars into a new English-language newspaper. The relative freedom of expression in Dubai's "media city" has made Dubai the headquarters for hundreds of international and regional magazines, newspapers, satellite television channels and Web sites looking to escape censorship in other Arab countries.

There are many legitimate reasons to criticize the Gulf emirates. Their banks house money for terrorist groups, and their free zones help Iran bypass sanctions. They are run by undemocratic regimes, and they have little respect for labor laws or gay rights. But the collapse of the Gulf economies does not just mean pulling the plug on the world's tallest building or largest shopping mall. It means losing some of the strongest forces for reform and stability in the region.

There's No Reason to Gloat Over Dubai's Fall by Zvika Krieger (a former correspondent for Newsweek in the Middle East, is an editor at the New Republic.)

Of all the victims of the global financial crisis, Dubai and its neighboring states are receiving little sympathy. The oil-rich Persian Gulf emirate, which until recently had been a glitzy boomtown attracting fortune-seekers from across the globe, is reported to be canceling 1,500 work visas every day. Its real-estate market has dropped 30% or more over the past few months.

Their indoor ski slopes have earned these sheikhdoms few friends. Los Angeles Times columnist Rosa Brooks shed no tears that "Dubai may be going down," finding it "hard not to be revolted" by a state that "doesn't really produce anything of value" but is a playground for "cold-eyed Russian oligarchs, coked-out London pop stars and the spoiled princelings of global finance." News reports have been dripping with schadenfreude. Newsweek recently bid "Goodbye, Dubai" on its cover, while Time wondered if the Gulf collapse means "no more Palm Islands?" In response to Dubai's decision to deny a visa to Israeli tennis player Shahar Pe'er, New York Times columnist Harvey Araton gloated, "Just like that, the glitter and promise of Dubai as an emerging international sports center evaporated into the cool desert night."

But it would be a mistake to dismiss Dubai, Abu Dhabi, Qatar and the other Gulf emirates as nouveau riche Bedouins on a petrodollar-fueled shopping spree. In a region mired in poverty and extremism, the Gulf emirates are shattering taboos and challenging traditional power structures. Their financial demise would be a great loss to the Middle East.

The Gulf emirates have become financial lifelines in the region, sustaining their less wealthy Arab neighbors through billions of dollars of direct investment, and providing tens of thousands of Arabs with jobs. Their free-zone model of development has been adopted in countries like Jordan and Saudi Arabia, and their tourism boom has overflowed into countries like Egypt and Syria. The Western businesses attracted to the Gulf are opening new markets across the region.

But the significance of the emirates goes beyond money. They have applied their pragmatic business strategies to diplomacy, using their financial independence and domestic stability to mediate disputes from Morocco to Libya to Yemen. Besting traditional regional powerhouses like Egypt and Saudi Arabia, Qatar was the only country that helped effectively mediate an end to Lebanon's violent conflict last year -- largely because it was the only country considered close enough to both Syria-backed Hezbollah and the Western-backed government to be trusted by both sides.

The recent controversy over Israeli tennis star Shahar Pe'er obscures the fact that Dubai and its neighbors are the only countries in the region (other than Egypt and Jordan) that have been willing to consistently violate the Arab League boycott of the Jewish state. Qatar opened an Israeli trade mission in 1995 and recently hosted Israeli Foreign Minister Tzipi Livni. Dubai has also allowed Israeli nationals to enter the emirate for conferences, and it is currently in high-level discussions to open an Israeli mission as well. In its discussions with New York University about its new satellite campus, Abu Dhabi has indicated a willingness to overrule visa restrictions relating to Israelis and signaled that it is re-evaluating the policy for all of the emirates. The negative attention garnered by the Pe'er decision will likely expedite this process.

The Gulf emirates are also revolutionizing education in the Middle East. Dubai is forming partnerships with institutions including NYU, Harvard, MIT and Cornell. While critics are right to be skeptical that these programs will measure up to their counterparts in America, they will certainly outperform the underfunded, overcrowded and censored universities that currently populate the region. These new institutions will bring Western ideas and high standards of education to Arabs across a region where traditional families are reluctant to send their children overseas for university, but are increasingly seeing the Gulf as a viable alternative.

Though there are still some restrictions on expression in the Gulf emirates, these states house some of the freest media in the region. Qatar's Al-Jazeera, the Arab world's most popular television channel, has broken the monopoly of state-controlled propaganda channels by featuring probing coverage on some of the region's most controversial topics. Abu Dhabi has pumped millions of dollars into a new English-language newspaper. The relative freedom of expression in Dubai's "media city" has made Dubai the headquarters for hundreds of international and regional magazines, newspapers, satellite television channels and Web sites looking to escape censorship in other Arab countries.

There are many legitimate reasons to criticize the Gulf emirates. Their banks house money for terrorist groups, and their free zones help Iran bypass sanctions. They are run by undemocratic regimes, and they have little respect for labor laws or gay rights. But the collapse of the Gulf economies does not just mean pulling the plug on the world's tallest building or largest shopping mall. It means losing some of the strongest forces for reform and stability in the region.

Out of the Pod this week: 22 Feb 09

Shuffle! The first song out of the 'pod this week is......"Trash City" by Transvision Vamp. What's not to like about a song you can sing along with the first time you hear it? "Trash City, Trash, Trash City....da dah...Trash City, Trash, Trash City....."

Only 27,688 songs to go.

Only 27,688 songs to go.

Thursday, 19 February 2009

Bidder's linked to Australian jailed in Dubai

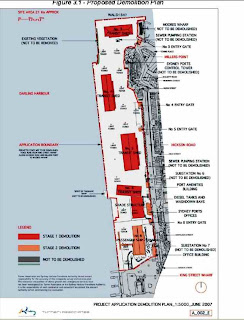

The proposed Barangaroo site on Sydney Harbour. Graphic from NSW Planning site

The proposed Barangaroo site on Sydney Harbour. Graphic from NSW Planning siteFrom the Sydney Morning Herald, written by Rick Feneley and Carolyn Cummins

February 19, 2009

February 19, 2009

The Australian chief of Dubai's biggest property development company has refused to answer questions about two fellow Australian colleagues who have been jailed on suspicion of bribery.

Chris O'Donnell is the chief executive officer of Dubai's biggest property developer, the state-owned Nakheel, which happens to be part of a consortium bidding to build Sydney's $2.5 billion Barangaroo development. (The link to the Planning NSW planning report is here. As background, Barangaroo is a 22-hectare waterfront site at East Darling Harbour in Sydney, Australia. The Barangaroo site will become an office/apartment/hotel complex....hmmm starting to sound familiar? The site is named after the wife of Bennelong, after whom nearby Bennelong Point, site of the Opera House, was named. The demolition plan is below. )

Chris O'Donnell is the chief executive officer of Dubai's biggest property developer, the state-owned Nakheel, which happens to be part of a consortium bidding to build Sydney's $2.5 billion Barangaroo development. (The link to the Planning NSW planning report is here. As background, Barangaroo is a 22-hectare waterfront site at East Darling Harbour in Sydney, Australia. The Barangaroo site will become an office/apartment/hotel complex....hmmm starting to sound familiar? The site is named after the wife of Bennelong, after whom nearby Bennelong Point, site of the Opera House, was named. The demolition plan is below. )

Last month, Nakheel dumped Mr O'Donnell's Australian colleague, Matt Joyce, as the general manager of Dubai Waterfront, the world's biggest waterfront development, amid the global credit squeeze and a freefall in Dubai's property values. Soon afterwards, Joyce, 43, and a 44-year-old Australian colleague were arrested as part of a fraud and corruption investigation.

Last month, Nakheel dumped Mr O'Donnell's Australian colleague, Matt Joyce, as the general manager of Dubai Waterfront, the world's biggest waterfront development, amid the global credit squeeze and a freefall in Dubai's property values. Soon afterwards, Joyce, 43, and a 44-year-old Australian colleague were arrested as part of a fraud and corruption investigation.The pair deny any wrongdoing but are being held without charge, according to their lawyer, as are about 20 executives caught up in the investigation.

Joyce's wife, Angela, and their three young children are still in Dubai, anxiously awaiting his release, as are the other man's family. The Herald understands both men attended Geelong Grammar.

The Gulf News has reported the bribery claims against them involve 43 million dirhams ($18.2 million) but their Australian lawyer, Martin Amad, insists no bribe was paid. He also says no charges have been laid, despite consular advice to the Department of Foreign Affairs and Trade that the men have been charged with an ``economic offence''. Mr Amad believes meaning of the word ``charge'' has been lost in translation.

Two days after receiving an extensive list of questions from the Herald, Mr O'Donnell's Dubai office responded last night by saying it would be "inappropriate for us to comment on any of your queries".

Nakheel is the biggest stakeholder in the Australian property group Mirvac, with a 14.9 per cent. Nakheel and Mirvac are in a consortium bidding for Barangaroo with Leighton Projects and Macquarie Property Development and Finance.

Nakheel has put many of its dazzling Dubai projects on hold and sacked hundreds of staff, and the Herald asked Mr O'Donnell's office if the company was still committed to Barangaroo. It replied that "at this stage, based on current government guidance for the project, we are working with our consortium partners ... towards a comprehensive bid".

When Mirvac reported a $645.7 million loss on Wednesday, its managing director, Nick Collishaw, said: "We have spoken to Nakheel, as we do with our major shareholders, and they remain committed to investing in our group.

"The group is also committed to its joint-venture deal in Barangaroo."

The deadline for the bids is March 31. The other shortlisted bidders Lend Lease/Westpac Corporation and Brookfield Multiplex.

In Australia, Mr O'Donnell had been managing director of Investa Property Group, once Australia's largest listed owner of commercial property, and executive director of Westpac Investment Property Limited.

New law bans sacking of Emirati nationals

Emiratis can be sacked only if they violate law

From the Gulf News written by Wafa Issa, 18 February 18, 2009

Private sector companies will face legal action if they sack Emiratis who have not violated the labour law, according to a new decision by the Ministry of Labour.

The decision comes after Al Futtaim Group sacked a number of Emiratis. Al Futtaim Group had said they were terminated because the company was "restructured in light of the current global financial crisis."

The new ministerial decision, regulating the termination of Emiratis in the private sector, issued on Tuesday, stipulates that companies can only sack Emiratis if they have violated the labour law, such as non-performance of basic duties, committing mistakes, which result in substantial material loss for the employer.

In other cases, companies must go back to the ministry before sacking Emiratis. Companies that do not comply will face legal action and the ministry will enforce a ban on issuing them new work permits until a court verdict is passed, according to the new decision.

Humaid Bin Deemas, acting director-general at the ministry, said the new decision is aimed at outlining the rights and duties of both employers and Emiratis in the private sector.

"The decision is to regulate the termination of Emiratis working in the private sector. It does not deprive the employer of the right to hold Emiratis accountable for their low-performance," said Bin Deemas.

Any termination of Emiratis will be considered unlawful if the same job is given to expatriates in light of restructuring policies of companies.

"The priority for work is for Emiratis and this right is protected in the labour law," said Bin Deemas.

Ahmad Al Naqbi, one of the Emiratis, who was sacked by Al Futtaim Group, said the decision indicated the government's commitment to protect their citizens.

Feddah Lootah, acting director-general at the National Human Resource Development and Employment Authority (Tanmia), said this decision will curb the practice of some companies to exploit the current global financial situation to escape from their Emiratisation responsibilities.

The rule will cover 14,861 Emiratis who work in the private sector and are currently registered at the Ministry of Labour. It does not cover Emiratis working in semi-government companies.

Wednesday, 18 February 2009

The Dubai bribery case makes the "Sydney Morning Herald"

From the Sydney Morning Herald

18 February 09

UNTIL his arrest for suspected bribery last month, Matt Joyce was in command of the world's biggest waterfront development, the most audacious project yet in Dubai Inc's high-rise fantasia.

Joyce, the Australian managing director of the state-backed Dubai Waterfront, boasted of its vital statistics in a recent interview. Stretching 30 kilometres, it would cover 14,000 hectares, making it twice the size of Hong Kong Island.

It would dwarf the emirate's famous World and Palms developments. It would reclaim six islands and involve shifting enough sand to fill Wembley Stadium three times every month. And it would become home to 400,000 people within five years.

"We have the luxury of creating this city on a blank canvas," said Joyce, who would oversee the construction of yet another space-age Atlantis rising from the Arabian Gulf.

But Dubai's blank canvas has become murky. Few of the world's property bubbles became as inflated as Dubai's, and few have burst so explosively in the global meltdown.

Joyce, 43, the former Sydney-based chief of the respected property group St Hilliers, was among five senior executives made redundant from Dubai Waterfront last month.

Then, on January 25, he and two Australian colleagues were taken in for questioning as part of a year-long crackdown on fraud and corruption among state-backed property developers and banks. One of the Australians, a 55-year-old man from Brisbane, was released. But Joyce and another Melbourne man, 44, are still being held without charge. Both have families in Dubai.

Last night, Sydney time, the prosecution was in court applying to extend their custody for another 15 to 30 days. Their Australian lawyer, Martin Amad, was there and told the Herald: "No charges have been laid and both men strenuously deny the allegations."

He said they were confident that authorities would soon determine their innocence based on documentation they had supplied. He would not name Joyce's colleague.

The men are among more than 20 executives in jail as part of Dubai's fraud and corruption investigation. All are yet to be charged, but some have spent almost a year behind bars. Dubai police have given no details on whom the Australians allegedly bribed.

Joyce's lawyer in Dubai, Salem Al Sha'ali, had told the Gulf News: "The suspected transaction cannot be considered a bribe. The figure isn't exact and the amount was given back because the deal didn't go through. It's a big misunderstanding."

Mr Amad said the quote, as reported, was inaccurate and he insisted there was no transaction and no deal. "No bribe was paid."

A former work colleague of Joyce's, from Australand in Sydney, described him as "straight and decent".

"If there's anything there, it would be totally out of character," he said.

For the 16 months before his shift to Dubai, in April 2006, Joyce was chief executive at

St Hilliers in Sydney. It is well known in the industry that he parted on unhappy terms, although his termination contract prevents St Hilliers revealing the reasons.

Joyce joined Dubai Waterfront, whose parent company is the government-owned Nakheel. Nakheel is the biggest developer in the United Arab Emirates and has projects worth about $US80 billion ($124 billion).

Asked how the Australians were being treated in jail, Mr Amad said they had no complaint. They were "anxious to be released" but there was slim chance overnight of bail.

Joyce had been made redundant shortly before his arrest. Asked if there were fears that the men were being made scapegoats for the broader corruption inquiry, Mr Amad said he could not comment. "It is not an argument we are putting forward."

Regardless of the case against the Australians, Dubai Inc is on trial in the eyes of the investment world, and the fraud crackdown has signalled the emirate's determination to send a clear message that it is a good place to do business.

Dubai property values are in free-fall. Some forecast they will drop by as much as 50 per cent this year.

Along with thousands of redundancies, local police reported at least 3000 cars abandoned outside Dubai International Airport in the four months to January. Many had keys in the ignition. It seems debt-ridden and jobless foreigners are fleeing Dubai.

Nakheel insists Dubai Waterfront is forging ahead.

Unlike the other emirates, Dubai has little oil to speak of. It has only its real estate, built on the whims of its rich and its rulers. Only on this can it guarantee its future as a global financial hub

18 February 09

UNTIL his arrest for suspected bribery last month, Matt Joyce was in command of the world's biggest waterfront development, the most audacious project yet in Dubai Inc's high-rise fantasia.

Joyce, the Australian managing director of the state-backed Dubai Waterfront, boasted of its vital statistics in a recent interview. Stretching 30 kilometres, it would cover 14,000 hectares, making it twice the size of Hong Kong Island.

It would dwarf the emirate's famous World and Palms developments. It would reclaim six islands and involve shifting enough sand to fill Wembley Stadium three times every month. And it would become home to 400,000 people within five years.

"We have the luxury of creating this city on a blank canvas," said Joyce, who would oversee the construction of yet another space-age Atlantis rising from the Arabian Gulf.

But Dubai's blank canvas has become murky. Few of the world's property bubbles became as inflated as Dubai's, and few have burst so explosively in the global meltdown.

Joyce, 43, the former Sydney-based chief of the respected property group St Hilliers, was among five senior executives made redundant from Dubai Waterfront last month.

Then, on January 25, he and two Australian colleagues were taken in for questioning as part of a year-long crackdown on fraud and corruption among state-backed property developers and banks. One of the Australians, a 55-year-old man from Brisbane, was released. But Joyce and another Melbourne man, 44, are still being held without charge. Both have families in Dubai.

Last night, Sydney time, the prosecution was in court applying to extend their custody for another 15 to 30 days. Their Australian lawyer, Martin Amad, was there and told the Herald: "No charges have been laid and both men strenuously deny the allegations."

He said they were confident that authorities would soon determine their innocence based on documentation they had supplied. He would not name Joyce's colleague.

The men are among more than 20 executives in jail as part of Dubai's fraud and corruption investigation. All are yet to be charged, but some have spent almost a year behind bars. Dubai police have given no details on whom the Australians allegedly bribed.

Joyce's lawyer in Dubai, Salem Al Sha'ali, had told the Gulf News: "The suspected transaction cannot be considered a bribe. The figure isn't exact and the amount was given back because the deal didn't go through. It's a big misunderstanding."

Mr Amad said the quote, as reported, was inaccurate and he insisted there was no transaction and no deal. "No bribe was paid."

A former work colleague of Joyce's, from Australand in Sydney, described him as "straight and decent".

"If there's anything there, it would be totally out of character," he said.

For the 16 months before his shift to Dubai, in April 2006, Joyce was chief executive at

St Hilliers in Sydney. It is well known in the industry that he parted on unhappy terms, although his termination contract prevents St Hilliers revealing the reasons.

Joyce joined Dubai Waterfront, whose parent company is the government-owned Nakheel. Nakheel is the biggest developer in the United Arab Emirates and has projects worth about $US80 billion ($124 billion).

Asked how the Australians were being treated in jail, Mr Amad said they had no complaint. They were "anxious to be released" but there was slim chance overnight of bail.

Joyce had been made redundant shortly before his arrest. Asked if there were fears that the men were being made scapegoats for the broader corruption inquiry, Mr Amad said he could not comment. "It is not an argument we are putting forward."

Regardless of the case against the Australians, Dubai Inc is on trial in the eyes of the investment world, and the fraud crackdown has signalled the emirate's determination to send a clear message that it is a good place to do business.

Dubai property values are in free-fall. Some forecast they will drop by as much as 50 per cent this year.

Along with thousands of redundancies, local police reported at least 3000 cars abandoned outside Dubai International Airport in the four months to January. Many had keys in the ignition. It seems debt-ridden and jobless foreigners are fleeing Dubai.

Nakheel insists Dubai Waterfront is forging ahead.

Unlike the other emirates, Dubai has little oil to speak of. It has only its real estate, built on the whims of its rich and its rulers. Only on this can it guarantee its future as a global financial hub

In defence of Dubai

From The Guardian 18 February 09

Written by Siobhan Campbell

Germaine Greer's account of her recent trip to Dubai is disappointing (An article titled From its artificial islands to its boring new skycraper, Dubai's architecture is beyond crass, 9 February).

Her verdict of Dubai as "crass" and "with neither charm nor character" lacks insight, and panders to the media pastime of rejoicing in the supposedly burst bubble of Dubai's prosperity.

As a Dubai resident I'm the first to admit that this place has its shortcomings, some of which are on a staggering environmental or humanitarian scale. The traffic and sewage problems that the city is currently experiencing are examples of this, but it cannot be overlooked that what was once a dusty fishing port and trading village has transformed itself in less than 40 years.

Sights such as the Burj Al Arab, the Palm Islands and the Burj Dubai, which Greer mentions, are being built on a jaw-dropping scale with the intention of attracting investment and tourists: with both of these come jobs. The UAE has long recognised the need to diversify its industries, and the fact that "only 6% of Dubai's revenue comes from oil" is testament to the success of this drive. One could argue that the entire mirage of "excess" and "megalomania" that Greer finds so crass is likewise created for tourist appeal.

In contrast, while Greer states that the dhows on Dubai Creek only have a purpose in taking "tourists on one-hour pleasure cruises", they are in fact an integral part of the city's transport network. Washing machines, televisions, DVD players and other household goods are unloaded from the dhows returning from India, Iran and the Gulf states, and stacked up on the creek banks without guard, where anyone can stroll past but where no one would dream of stealing anything - a remarkable sight to tourists but one, it would seem, that isn't on the tour bus route.

"Here, there is no subsistence; here there is only shopping," says Greer - a predictable response from someone who has taken a bus tour of Dubai's shopping malls and construction sites without setting foot in the city to witness its dynamism. Dubai has an intrinsic impermanence by virtue of its ever-changing skyline and its workforce of expats who are forever coming and going. Many find this constant flux energising and revitalising, rather than seeing it as a reflection of the city's superficiality.

As for Dubai having "neither charm nor character", Greer has failed to appreciate the dichotomy between Dubai's need to modernise and its desire to retain its cultural identity. With a population of whom only 20% are nationals, forging a single cultural identity will always be a challenge; but if it's history and heritage you're after then the Bastakiya and Bur Dubai areas should be on any tourist's itinerary.

The assumption that one can get a true sense of a place from a whirlwind visit compounds the popular view that Dubai's culture is skin deep and that the city is the epitome of the throwaway consumerist society. What did Ms Greer expect from four hours on a bus?

• Siobhan Campbell is a writer and editor for Explorer Publishing in Dubai siobhan@explorerpublishing.com

Written by Siobhan Campbell

Germaine Greer's account of her recent trip to Dubai is disappointing (An article titled From its artificial islands to its boring new skycraper, Dubai's architecture is beyond crass, 9 February).

Her verdict of Dubai as "crass" and "with neither charm nor character" lacks insight, and panders to the media pastime of rejoicing in the supposedly burst bubble of Dubai's prosperity.

As a Dubai resident I'm the first to admit that this place has its shortcomings, some of which are on a staggering environmental or humanitarian scale. The traffic and sewage problems that the city is currently experiencing are examples of this, but it cannot be overlooked that what was once a dusty fishing port and trading village has transformed itself in less than 40 years.

Sights such as the Burj Al Arab, the Palm Islands and the Burj Dubai, which Greer mentions, are being built on a jaw-dropping scale with the intention of attracting investment and tourists: with both of these come jobs. The UAE has long recognised the need to diversify its industries, and the fact that "only 6% of Dubai's revenue comes from oil" is testament to the success of this drive. One could argue that the entire mirage of "excess" and "megalomania" that Greer finds so crass is likewise created for tourist appeal.

In contrast, while Greer states that the dhows on Dubai Creek only have a purpose in taking "tourists on one-hour pleasure cruises", they are in fact an integral part of the city's transport network. Washing machines, televisions, DVD players and other household goods are unloaded from the dhows returning from India, Iran and the Gulf states, and stacked up on the creek banks without guard, where anyone can stroll past but where no one would dream of stealing anything - a remarkable sight to tourists but one, it would seem, that isn't on the tour bus route.

"Here, there is no subsistence; here there is only shopping," says Greer - a predictable response from someone who has taken a bus tour of Dubai's shopping malls and construction sites without setting foot in the city to witness its dynamism. Dubai has an intrinsic impermanence by virtue of its ever-changing skyline and its workforce of expats who are forever coming and going. Many find this constant flux energising and revitalising, rather than seeing it as a reflection of the city's superficiality.

As for Dubai having "neither charm nor character", Greer has failed to appreciate the dichotomy between Dubai's need to modernise and its desire to retain its cultural identity. With a population of whom only 20% are nationals, forging a single cultural identity will always be a challenge; but if it's history and heritage you're after then the Bastakiya and Bur Dubai areas should be on any tourist's itinerary.

The assumption that one can get a true sense of a place from a whirlwind visit compounds the popular view that Dubai's culture is skin deep and that the city is the epitome of the throwaway consumerist society. What did Ms Greer expect from four hours on a bus?

• Siobhan Campbell is a writer and editor for Explorer Publishing in Dubai siobhan@explorerpublishing.com

Monday, 16 February 2009

Emirates ID card deadline extended

Oh what a surprise….. After the misery, the worry, the wasted hours spent in queues or in futile attempts to access the EIDA website, topped off by the complete lack of credible, timely, accurate information from the authority concerned, yes after all that, the National newspaper announced today that the deadline for expats to obtain the Emirates ID card has been postponed to 31 December 2011.

Of course, the way things are going in Dubai, there'll only be 40 expats left by then (one in each branch of Costas).

Of course, the way things are going in Dubai, there'll only be 40 expats left by then (one in each branch of Costas).

Meanwhile, over in Qatar cars are being abandoned with abandon....

Qatar sees huge hike in abandoned cars

From ArabianBusiness.com Sunday, 15 February 2009

Doha has seen a 791 percent increase in the number of cars being abandoned on its streets and outskirts, it was reported on Sunday. The city’s municipality has revealed that in January this year 1,448 vehicles were deemed to be left unclaimed. This is a huge hike on the 183 found abandoned in January 2008, according to local Arabic daily Arrayah and reported in Qatar daily Gulf Times. A designated yard for abandoned vehicles was full to capacity, director of Doha Municipality, Ibrahim Al Malky told the newspaper.

“There is practically no space left because vehicles are already stockpiled one over the other,” he revealed.There was an urgent need for a coordinated effort to allocate a new areas for the cars, Al Malky added.No reason for the increase was given. However, the findings come a week after Dubai’s authorities denied that it was seeing more cars abandoned at the airport as a result of expatriates fleeing the UAE on the back of the economic crisis.

Only 11 cars had been left at Dubai International Airport in over a year, confirmed lieutenant general Dhahi Khalfan Tamim, chief of the Dubai police department. Clarification on the number of abandoned cars came after repeated local and international media reports that the figure had hit 3,000.

The municipal officials in Doha dealing with public hygiene and cleanliness periodically monitor the number vehicles found abandoned on the city streets. They place stickers on such vehicles and photographs are taken and forwarded to the public cleanliness department which is responsible for removing them to the junkyard.

From ArabianBusiness.com Sunday, 15 February 2009

Doha has seen a 791 percent increase in the number of cars being abandoned on its streets and outskirts, it was reported on Sunday. The city’s municipality has revealed that in January this year 1,448 vehicles were deemed to be left unclaimed. This is a huge hike on the 183 found abandoned in January 2008, according to local Arabic daily Arrayah and reported in Qatar daily Gulf Times. A designated yard for abandoned vehicles was full to capacity, director of Doha Municipality, Ibrahim Al Malky told the newspaper.

“There is practically no space left because vehicles are already stockpiled one over the other,” he revealed.There was an urgent need for a coordinated effort to allocate a new areas for the cars, Al Malky added.No reason for the increase was given. However, the findings come a week after Dubai’s authorities denied that it was seeing more cars abandoned at the airport as a result of expatriates fleeing the UAE on the back of the economic crisis.

Only 11 cars had been left at Dubai International Airport in over a year, confirmed lieutenant general Dhahi Khalfan Tamim, chief of the Dubai police department. Clarification on the number of abandoned cars came after repeated local and international media reports that the figure had hit 3,000.

The municipal officials in Doha dealing with public hygiene and cleanliness periodically monitor the number vehicles found abandoned on the city streets. They place stickers on such vehicles and photographs are taken and forwarded to the public cleanliness department which is responsible for removing them to the junkyard.

Sunday, 15 February 2009

Out of the Pod this week 15 Feb 09

First day of the working week, into the car, start 'er up and put the iPod on shuffle. The first song out of the 'pod this week was:

'The One I Love' by REM (you know the way it goes "...this one goes out to the one I love etc etc."

Only 27,689 songs to go....

'The One I Love' by REM (you know the way it goes "...this one goes out to the one I love etc etc."

Only 27,689 songs to go....

The mist rises around Al Fajer.

From the Wall Street Journal 14th February 2009

Written by Margaret Croker

Amid the movers and shakers of this glittering city, Shahram Abdullah Zadeh cut a wide swathe. He cruised around town in a white Bentley and dined with royalty as his company developed one of the emirate’s premier office complexes.

But last February, a phone call from Dubai’s state security effectively ended it all.

Hauled in and locked up for 60 days, Mr. Zadeh says he was interrogated about his role in Dubai’s freewheeling real-estate sector and his business relationship with the brother-in-law of Dubai’s ruler, Sheikh Mohammed bin Rashid Al Maktoum. When released, Mr. Zadeh says he had been frozen out of the real-estate company he had helped start.

Mr. Zadeh’s experience, compiled though court and company documents, offers a rare window into the murky business world that helped transform this city from an empty coastline into a metropolis. It also may offer a cautionary tale for investors lured to the city, which bills itself as the modern face of a new Middle East. Dubai is one of seven semi-autonomous emirates that make up the United Arab Emirates.

The U.S. government and human-rights groups have long criticized the judicial system in the U.A.E for a lack of independence and oversight. In the good times, investors didn’t fret much about these shortcomings. Now, some of the same deals that helped build Dubai are coming undone — in particular, a tradition of off-the-book business partnerships between Emirati citizens and elite expatriates like Mr. Zadeh, who was born in Iran.

Mr. Zadeh claims his detention came after a business dispute with his partner at Al Fajer Properties, Sheikh Hasher bin Juma’a Al Maktoum and his son, Sheikh Maktoum bin Hasher al Maktoum. Both men are members of the extended family of Dubai’s ruler, Sheikh Mohammed bin Rashid Al Maktoum. Mr. Zadeh alleges the two men took control of the firm while he was in custody, according to a lawsuit he filed with Dubai’s public prosecution office last year.

Mr. Zadeh has not been charged with a crime. But for the past year, authorities have held onto his passport, making it impossible for him to travel or find work.

“I used to believe in the miracle of Dubai. But now I see it all as a mirage,” said Mr. Zadeh, 37. Sheikh Hasher denies any wrongdoing. He says he was not responsible for Mr. Zadeh’s jailing and that he removed him from the company because Dubai authorities said he had offered bribes, an allegation Mr. Zadeh denies.

“I don’t need to defend my reputation. He does,” Sheikh Hasher said in a telephone interview. “This man is crazy. He is a crook with a sweet tongue.”

Some of Mr. Zadeh’s claims are impossible to verify independently. His only copy of the real-estate partnership agreement is missing, and official company documents show the Sheikh Hasher as sole owner. Dubai’s security services, the public prosecutors’ office and the Dubai ruler’s court all either declined to comment or didn’t respond to repeated requests for comment.

Last fall, the Emirates’ Human Rights Association, a government body, wrote to authorities asking for an explanation about why Mr. Zadeh’s passport was being held. The group did not receive any response, according to his lawyers.

Mr. Zadeh grew up in Dubai, attending school with the children of some of the city’s top families. He managed his family’s hotel and retail holdings and decided to go into business himself in 2000. Real-estate development was off limits to foreigners, even longtime residents like himself. So, he turned to a common practice — a silent partnership with a U.A.E. citizen.

Typically, such partnerships involve an Emirati acquiring a business license and then granting his foreign partner management control. The foreigner either pays an annual fee to the Emirati or the two share profits. The terms are set forth in a parallel set of documents, separate from those submitted to the government. Such contracts are so common that courts here have upheld them in disputes, according to commercial lawyers here.

In 2004, an old friend of Mr. Zadeh’s father brokered an introduction with Sheikh Hasher. The sheikh owns Al Fajer Enterprises, a conglomerate that includes a large construction and contracting arm.

In affidavits filed with Dubai’s prosecution office, Mr. Zadeh contends that he and Sheikh Hasher verbally agreed to a partnership, signing a contract on Feb. 1, 2006. The partnership, Mr. Zadeh says, established the two men as co-owners of Al Fajer Properties. The men would split profits equally and would invest equal amounts of capital. The contract named Mr. Zadeh as chief executive.

Mr. Zadeh provided $335,000 in start-up capital, and he invested another approximately $30 million in the company, according to bank documents reviewed by The Wall Street Journal. Mr. Zadeh’s affidavits contend Sheikh Hasher didn’t contribute any capital. Sheikh Hasher denies the equity partnership ever existed.

Business took off quickly. One of Al Fajer’s biggest projects was a planned $750-million development of five office towers, set just inland from Dubai’s man-made, palm-tree-shaped island. Mr. Zadeh bought three of the five plots for the 40-story towers with his own money, according to financial documents. With investors lined up for units, he then awarded $215 million worth of contracts to the construction arm of Sheikh Hasher’s Al Fajer Enterprises, according to company documents.

But by late 2007, the contractors were behind schedule, according to company documents and former employees. Al Fajer Properties was facing fines for the delays, and buyers were starting to complain. Sheikh Hasher wanted payments to continue to his companies, but Mr. Zadeh claims he said no. The sheikh complained in a series of text messages that unless Mr. Zadeh released more cash, his contracting companies would go bankrupt.

On Feb. 21, 2008, Mr. Zadeh claims, he received an unusual phone call from State Security, asking him to come in that evening for a talk. When he arrived, , he claims that police blindfolded him, put him into a sport-utility vehicle and drove him to a detention center.

In the eight weeks he was jailed, Mr. Zadeh says he was never accused of a specific crime or shown an arrest warrant. Instead, he says, he was repeatedly interrogated about his personal life and Al Fajer’s operations, and gave his interrogators the combination to the company’s safe after they asked for it. “They told me that if I did not cooperate that they would ruin me,” Mr. Zadeh said.

Mr. Zadeh contends the only copy of his partnership agreement with Sheikh Hasher was in the safe. Former employees of Al Fajer say the company safe was emptied while Mr. Zadeh was jailed.

On March 6, Sheikh Hasher’s son, Sheikh Maktoum, was named the new chief executive of Al Fajer Properties. Sheikh Hasher hired international accountants to audit Al Fajer’s books, according to former employees. He then presented the findings to employees and select clients, accusing Mr. Zadeh of embezzling funds. Phone calls and emails sent to lawyers and accountants of Al Fajer Properties were not returned.

Sheikh Hasher says Mr. Zadeh stole money from him, but did not provide evidence, or the audit, to back his claim. Mr. Zadeh denies it.

Prosecutors refused to investigate the case, citing an order from Dubai’s attorney general, an official appointed by the ruler. In November, Mr. Zadeh tried one last option. He approached the ruler’s diwan, or court administration, and asked for mediation from Sheikh Mohammed himself.

So far, there has been no reply.

Write to Margaret Coker at margaret.coker@wsj.com

Written by Margaret Croker

Amid the movers and shakers of this glittering city, Shahram Abdullah Zadeh cut a wide swathe. He cruised around town in a white Bentley and dined with royalty as his company developed one of the emirate’s premier office complexes.

But last February, a phone call from Dubai’s state security effectively ended it all.

Hauled in and locked up for 60 days, Mr. Zadeh says he was interrogated about his role in Dubai’s freewheeling real-estate sector and his business relationship with the brother-in-law of Dubai’s ruler, Sheikh Mohammed bin Rashid Al Maktoum. When released, Mr. Zadeh says he had been frozen out of the real-estate company he had helped start.

Mr. Zadeh’s experience, compiled though court and company documents, offers a rare window into the murky business world that helped transform this city from an empty coastline into a metropolis. It also may offer a cautionary tale for investors lured to the city, which bills itself as the modern face of a new Middle East. Dubai is one of seven semi-autonomous emirates that make up the United Arab Emirates.

The U.S. government and human-rights groups have long criticized the judicial system in the U.A.E for a lack of independence and oversight. In the good times, investors didn’t fret much about these shortcomings. Now, some of the same deals that helped build Dubai are coming undone — in particular, a tradition of off-the-book business partnerships between Emirati citizens and elite expatriates like Mr. Zadeh, who was born in Iran.

Mr. Zadeh claims his detention came after a business dispute with his partner at Al Fajer Properties, Sheikh Hasher bin Juma’a Al Maktoum and his son, Sheikh Maktoum bin Hasher al Maktoum. Both men are members of the extended family of Dubai’s ruler, Sheikh Mohammed bin Rashid Al Maktoum. Mr. Zadeh alleges the two men took control of the firm while he was in custody, according to a lawsuit he filed with Dubai’s public prosecution office last year.

Mr. Zadeh has not been charged with a crime. But for the past year, authorities have held onto his passport, making it impossible for him to travel or find work.

“I used to believe in the miracle of Dubai. But now I see it all as a mirage,” said Mr. Zadeh, 37. Sheikh Hasher denies any wrongdoing. He says he was not responsible for Mr. Zadeh’s jailing and that he removed him from the company because Dubai authorities said he had offered bribes, an allegation Mr. Zadeh denies.

“I don’t need to defend my reputation. He does,” Sheikh Hasher said in a telephone interview. “This man is crazy. He is a crook with a sweet tongue.”

Some of Mr. Zadeh’s claims are impossible to verify independently. His only copy of the real-estate partnership agreement is missing, and official company documents show the Sheikh Hasher as sole owner. Dubai’s security services, the public prosecutors’ office and the Dubai ruler’s court all either declined to comment or didn’t respond to repeated requests for comment.

Last fall, the Emirates’ Human Rights Association, a government body, wrote to authorities asking for an explanation about why Mr. Zadeh’s passport was being held. The group did not receive any response, according to his lawyers.

Mr. Zadeh grew up in Dubai, attending school with the children of some of the city’s top families. He managed his family’s hotel and retail holdings and decided to go into business himself in 2000. Real-estate development was off limits to foreigners, even longtime residents like himself. So, he turned to a common practice — a silent partnership with a U.A.E. citizen.

Typically, such partnerships involve an Emirati acquiring a business license and then granting his foreign partner management control. The foreigner either pays an annual fee to the Emirati or the two share profits. The terms are set forth in a parallel set of documents, separate from those submitted to the government. Such contracts are so common that courts here have upheld them in disputes, according to commercial lawyers here.

In 2004, an old friend of Mr. Zadeh’s father brokered an introduction with Sheikh Hasher. The sheikh owns Al Fajer Enterprises, a conglomerate that includes a large construction and contracting arm.

In affidavits filed with Dubai’s prosecution office, Mr. Zadeh contends that he and Sheikh Hasher verbally agreed to a partnership, signing a contract on Feb. 1, 2006. The partnership, Mr. Zadeh says, established the two men as co-owners of Al Fajer Properties. The men would split profits equally and would invest equal amounts of capital. The contract named Mr. Zadeh as chief executive.

Mr. Zadeh provided $335,000 in start-up capital, and he invested another approximately $30 million in the company, according to bank documents reviewed by The Wall Street Journal. Mr. Zadeh’s affidavits contend Sheikh Hasher didn’t contribute any capital. Sheikh Hasher denies the equity partnership ever existed.

Business took off quickly. One of Al Fajer’s biggest projects was a planned $750-million development of five office towers, set just inland from Dubai’s man-made, palm-tree-shaped island. Mr. Zadeh bought three of the five plots for the 40-story towers with his own money, according to financial documents. With investors lined up for units, he then awarded $215 million worth of contracts to the construction arm of Sheikh Hasher’s Al Fajer Enterprises, according to company documents.

But by late 2007, the contractors were behind schedule, according to company documents and former employees. Al Fajer Properties was facing fines for the delays, and buyers were starting to complain. Sheikh Hasher wanted payments to continue to his companies, but Mr. Zadeh claims he said no. The sheikh complained in a series of text messages that unless Mr. Zadeh released more cash, his contracting companies would go bankrupt.

On Feb. 21, 2008, Mr. Zadeh claims, he received an unusual phone call from State Security, asking him to come in that evening for a talk. When he arrived, , he claims that police blindfolded him, put him into a sport-utility vehicle and drove him to a detention center.

In the eight weeks he was jailed, Mr. Zadeh says he was never accused of a specific crime or shown an arrest warrant. Instead, he says, he was repeatedly interrogated about his personal life and Al Fajer’s operations, and gave his interrogators the combination to the company’s safe after they asked for it. “They told me that if I did not cooperate that they would ruin me,” Mr. Zadeh said.

Mr. Zadeh contends the only copy of his partnership agreement with Sheikh Hasher was in the safe. Former employees of Al Fajer say the company safe was emptied while Mr. Zadeh was jailed.

On March 6, Sheikh Hasher’s son, Sheikh Maktoum, was named the new chief executive of Al Fajer Properties. Sheikh Hasher hired international accountants to audit Al Fajer’s books, according to former employees. He then presented the findings to employees and select clients, accusing Mr. Zadeh of embezzling funds. Phone calls and emails sent to lawyers and accountants of Al Fajer Properties were not returned.

Sheikh Hasher says Mr. Zadeh stole money from him, but did not provide evidence, or the audit, to back his claim. Mr. Zadeh denies it.

Prosecutors refused to investigate the case, citing an order from Dubai’s attorney general, an official appointed by the ruler. In November, Mr. Zadeh tried one last option. He approached the ruler’s diwan, or court administration, and asked for mediation from Sheikh Mohammed himself.

So far, there has been no reply.

Write to Margaret Coker at margaret.coker@wsj.com

The Dubai fraud case reaches the Australian press

From the Sydney Morning Herald, 15th Feb 2009

Australians in Dubai face fraud charges

* Taghred Chandab, Dubai

An Australian man appointed to spearhead the construction of the world's largest coastal development has been arrested in the Middle East after a government investigation into alleged corruption and bribery.

Matt Joyce, 44, and an unnamed 43-year-old Victorian man were taken into custody in Dubai on January 25 and charged with fraud.

The Sun-Herald understands that a third man, from Queensland, was also detained and questioned in relation to bribery allegations but was later released.

A spokesman for Australia's Department of Foreign Affairs and Trade confirmed the men had been charged with fraud.

"We understand both men will apply for bail but it is unknown if it will be granted," he said. "The Consulate-General visited the men last week and is providing them and their families with support."

Joyce joined Nakheel, the government-owned parent company of Dubai Waterfront, and the United Arab Emirates' largest developer with a portfolio estimated to be worth $US80 billion ($122 billion), in April 2006.

He was the chief executive of Sydney-based property developer St Hilliers before moving to Dubai.

He was one of five Dubai Waterfront senior managers who were recently made redundant as a result of the economic downturn and was due to leave the company in April.

The arrest of the Australian men comes after more than 20 executives were detained in the past year for corruption. Many of the senior managers, who worked for government-owned companies, remain in jail without charge.

If the men are found guilty they face a lengthy jail term followed by deportation.

Australians in Dubai face fraud charges

* Taghred Chandab, Dubai

An Australian man appointed to spearhead the construction of the world's largest coastal development has been arrested in the Middle East after a government investigation into alleged corruption and bribery.

Matt Joyce, 44, and an unnamed 43-year-old Victorian man were taken into custody in Dubai on January 25 and charged with fraud.

The Sun-Herald understands that a third man, from Queensland, was also detained and questioned in relation to bribery allegations but was later released.

A spokesman for Australia's Department of Foreign Affairs and Trade confirmed the men had been charged with fraud.

"We understand both men will apply for bail but it is unknown if it will be granted," he said. "The Consulate-General visited the men last week and is providing them and their families with support."

Joyce joined Nakheel, the government-owned parent company of Dubai Waterfront, and the United Arab Emirates' largest developer with a portfolio estimated to be worth $US80 billion ($122 billion), in April 2006.

He was the chief executive of Sydney-based property developer St Hilliers before moving to Dubai.

He was one of five Dubai Waterfront senior managers who were recently made redundant as a result of the economic downturn and was due to leave the company in April.

The arrest of the Australian men comes after more than 20 executives were detained in the past year for corruption. Many of the senior managers, who worked for government-owned companies, remain in jail without charge.

If the men are found guilty they face a lengthy jail term followed by deportation.

Thursday, 12 February 2009

"Laid-Off Foreigners Flee as Dubai Spirals Down"

NY Times February 12, 2009

Laid-Off Foreigners Flee as Dubai Spirals Down

By ROBERT F. WORTH

Sofia, a 34-year-old Frenchwoman, moved here a year ago to take a job in advertising, so confident about Dubai’s fast-growing economy that she bought an apartment for almost $300,000 with a 15-year mortgage.

Now, like many of the foreign workers who make up 90 percent of the population here, she has been laid off and faces the prospect of being forced to leave this Persian Gulf city — or worse.

“I’m really scared of what could happen, because I bought property here,” said Sofia, who asked that her last name be withheld because she is still hunting for a new job. “If I can’t pay it off, I was told I could end up in debtors’ prison.”

With Dubai’s economy in free fall, newspapers have reported that more than 3,000 cars sit abandoned in the parking lot at the Dubai Airport, left by fleeing, debt-ridden foreigners (who could in fact be imprisoned if they failed to pay their bills). Some are said to have maxed-out credit cards inside and notes of apology taped to the windshield.

The government says the real number is much lower. But the stories contain at least a grain of truth: jobless people here lose their work visas and then must leave the country within a month. That in turn reduces spending, creates housing vacancies and lowers real estate prices, in a downward spiral that has left parts of Dubai — once hailed as the economic superpower of the Middle East — looking like a ghost town.

No one knows how bad things have become, though it is clear that tens of thousands have left, real estate prices have crashed and scores of Dubai’s major construction projects have been suspended or canceled. But with the government unwilling to provide data, rumors are bound to flourish, damaging confidence and further undermining the economy.

Instead of moving toward greater transparency, the emirates seem to be moving in the other direction. A new draft media law would make it a crime to damage the country’s reputation or economy, punishable by fines of up to 1 million dirhams (about $272,000). Some say it is already having a chilling effect on reporting about the crisis.

Last month, local newspapers reported that Dubai was canceling 1,500 work visas every day, citing unnamed government officials. Asked about the number, Humaid bin Dimas, a spokesman for Dubai’s Labor Ministry, said he would not confirm or deny it and refused to comment further. Some say the true figure is much higher.

“At the moment there is a readiness to believe the worst,” said Simon Williams, HSBC bank’s chief economist in Dubai. “And the limits on data make it difficult to counter the rumors.”

Some things are clear: real estate prices, which rose dramatically during Dubai’s six-year boom, have dropped 30 percent or more over the past two or three months in some parts of the city. Last week, Moody’s Investor’s Service announced that it might downgrade its ratings on six of Dubai’s most prominent state-owned companies, citing a deterioration in the economic outlook. So many used luxury cars are for sale , they are sometimes sold for 40 percent less than the asking price two months ago, car dealers say. Dubai’s roads, usually thick with traffic at this time of year, are now mostly clear.

Some analysts say the crisis is likely to have long-lasting effects on the seven-member emirates federation, where Dubai has long played rebellious younger brother to oil-rich and more conservative Abu Dhabi. Dubai officials, swallowing their pride, have made clear that they would be open to a bailout, but so far Abu Dhabi has offered assistance only to its own banks.

“Why is Abu Dhabi allowing its neighbor to have its international reputation trashed, when it could bail out Dubai’s banks and restore confidence?” said Christopher M. Davidson, who predicted the current crisis in “Dubai: The Vulnerability of Success,” a book published last year. “Perhaps the plan is to centralize the U.A.E.” under Abu Dhabi’s control, he mused, in a move that would sharply curtail Dubai’s independence and perhaps change its signature freewheeling style.

For many foreigners, Dubai had seemed at first to be a refuge, relatively insulated from the panic that began hitting the rest of the world last autumn. The Persian Gulf is cushioned by vast oil and gas wealth, and some who lost jobs in New York and London began applying here.

But Dubai, unlike Abu Dhabi or nearby Qatar and Saudi Arabia, does not have its own oil, and had built its reputation on real estate, finance and tourism. Now, many expatriates here talk about Dubai as though it were a con game all along. Lurid rumors spread quickly: the Palm Jumeira, an artificial island that is one of this city’s trademark developments, is said to be sinking, and when you turn the faucets in the hotels built atop it, only cockroaches come out.

“Is it going to get better? They tell you that, but I don’t know what to believe anymore,” said Sofia, who still hopes to find a job before her time runs out. “People are really panicking quickly.”

Hamza Thiab, a 27-year-old Iraqi who moved here from Baghdad in 2005, lost his job with an engineering firm six weeks ago. He has until the end of February to find a job, or he must leave. “I’ve been looking for a new job for three months, and I’ve only had two interviews,” he said. “Before, you used to open up the papers here and see dozens of jobs. The minimum for a civil engineer with four years’ experience used to be 15,000 dirhams a month. Now, the maximum you’ll get is 8,000,” or about $2,000.

Mr. Thiab was sitting in a Costa Coffee Shop in the Ibn Battuta mall, where most of the customers seemed to be single men sitting alone, dolefully drinking coffee at midday. If he fails to find a job, he will have to go to Jordan, where he has family members — Iraq is still too dangerous, he says — though the situation is no better there. Before that, he will have to borrow money from his father to pay off the more than $12,000 he still owes on a bank loan for his Honda Civic. Iraqi friends bought fancier cars and are now, with no job, struggling to sell them.

“Before, so many of us were living a good life here,” Mr. Thiab said. “Now we cannot pay our loans. We are all just sleeping, smoking, drinking coffee and having headaches because of the situation.”

A New York Times employee in Dubai contributed reporting.

Laid-Off Foreigners Flee as Dubai Spirals Down

By ROBERT F. WORTH

Sofia, a 34-year-old Frenchwoman, moved here a year ago to take a job in advertising, so confident about Dubai’s fast-growing economy that she bought an apartment for almost $300,000 with a 15-year mortgage.

Now, like many of the foreign workers who make up 90 percent of the population here, she has been laid off and faces the prospect of being forced to leave this Persian Gulf city — or worse.

“I’m really scared of what could happen, because I bought property here,” said Sofia, who asked that her last name be withheld because she is still hunting for a new job. “If I can’t pay it off, I was told I could end up in debtors’ prison.”

With Dubai’s economy in free fall, newspapers have reported that more than 3,000 cars sit abandoned in the parking lot at the Dubai Airport, left by fleeing, debt-ridden foreigners (who could in fact be imprisoned if they failed to pay their bills). Some are said to have maxed-out credit cards inside and notes of apology taped to the windshield.

The government says the real number is much lower. But the stories contain at least a grain of truth: jobless people here lose their work visas and then must leave the country within a month. That in turn reduces spending, creates housing vacancies and lowers real estate prices, in a downward spiral that has left parts of Dubai — once hailed as the economic superpower of the Middle East — looking like a ghost town.

No one knows how bad things have become, though it is clear that tens of thousands have left, real estate prices have crashed and scores of Dubai’s major construction projects have been suspended or canceled. But with the government unwilling to provide data, rumors are bound to flourish, damaging confidence and further undermining the economy.

Instead of moving toward greater transparency, the emirates seem to be moving in the other direction. A new draft media law would make it a crime to damage the country’s reputation or economy, punishable by fines of up to 1 million dirhams (about $272,000). Some say it is already having a chilling effect on reporting about the crisis.

Last month, local newspapers reported that Dubai was canceling 1,500 work visas every day, citing unnamed government officials. Asked about the number, Humaid bin Dimas, a spokesman for Dubai’s Labor Ministry, said he would not confirm or deny it and refused to comment further. Some say the true figure is much higher.

“At the moment there is a readiness to believe the worst,” said Simon Williams, HSBC bank’s chief economist in Dubai. “And the limits on data make it difficult to counter the rumors.”

Some things are clear: real estate prices, which rose dramatically during Dubai’s six-year boom, have dropped 30 percent or more over the past two or three months in some parts of the city. Last week, Moody’s Investor’s Service announced that it might downgrade its ratings on six of Dubai’s most prominent state-owned companies, citing a deterioration in the economic outlook. So many used luxury cars are for sale , they are sometimes sold for 40 percent less than the asking price two months ago, car dealers say. Dubai’s roads, usually thick with traffic at this time of year, are now mostly clear.

Some analysts say the crisis is likely to have long-lasting effects on the seven-member emirates federation, where Dubai has long played rebellious younger brother to oil-rich and more conservative Abu Dhabi. Dubai officials, swallowing their pride, have made clear that they would be open to a bailout, but so far Abu Dhabi has offered assistance only to its own banks.

“Why is Abu Dhabi allowing its neighbor to have its international reputation trashed, when it could bail out Dubai’s banks and restore confidence?” said Christopher M. Davidson, who predicted the current crisis in “Dubai: The Vulnerability of Success,” a book published last year. “Perhaps the plan is to centralize the U.A.E.” under Abu Dhabi’s control, he mused, in a move that would sharply curtail Dubai’s independence and perhaps change its signature freewheeling style.

For many foreigners, Dubai had seemed at first to be a refuge, relatively insulated from the panic that began hitting the rest of the world last autumn. The Persian Gulf is cushioned by vast oil and gas wealth, and some who lost jobs in New York and London began applying here.

But Dubai, unlike Abu Dhabi or nearby Qatar and Saudi Arabia, does not have its own oil, and had built its reputation on real estate, finance and tourism. Now, many expatriates here talk about Dubai as though it were a con game all along. Lurid rumors spread quickly: the Palm Jumeira, an artificial island that is one of this city’s trademark developments, is said to be sinking, and when you turn the faucets in the hotels built atop it, only cockroaches come out.

“Is it going to get better? They tell you that, but I don’t know what to believe anymore,” said Sofia, who still hopes to find a job before her time runs out. “People are really panicking quickly.”

Hamza Thiab, a 27-year-old Iraqi who moved here from Baghdad in 2005, lost his job with an engineering firm six weeks ago. He has until the end of February to find a job, or he must leave. “I’ve been looking for a new job for three months, and I’ve only had two interviews,” he said. “Before, you used to open up the papers here and see dozens of jobs. The minimum for a civil engineer with four years’ experience used to be 15,000 dirhams a month. Now, the maximum you’ll get is 8,000,” or about $2,000.

Mr. Thiab was sitting in a Costa Coffee Shop in the Ibn Battuta mall, where most of the customers seemed to be single men sitting alone, dolefully drinking coffee at midday. If he fails to find a job, he will have to go to Jordan, where he has family members — Iraq is still too dangerous, he says — though the situation is no better there. Before that, he will have to borrow money from his father to pay off the more than $12,000 he still owes on a bank loan for his Honda Civic. Iraqi friends bought fancier cars and are now, with no job, struggling to sell them.

“Before, so many of us were living a good life here,” Mr. Thiab said. “Now we cannot pay our loans. We are all just sleeping, smoking, drinking coffee and having headaches because of the situation.”

A New York Times employee in Dubai contributed reporting.

Emirati nationals made redundant - sue their employer

Emiratis allege arbitrary termination of services

From The National: Wafa Issa

Published: February 11, 2009, 22:55

A group of Emiratis, who were made redundant due to the financial downturn, have filed a complaint against their employer at the Ministry of Labour citing arbitrary termination.

More than 20 Emiratis filed a complaint last week against the Al Futtaim Group (Omar not Majed), their former employer, demanding immediate reinstatement and compensation on moral grounds. They also filed a complaint at the Dubai Ruler's court.

A senior official at the Ministry of Labour confirmed that they received the complaint and are looking into it.

Ahmad Ebrahim. a sales executive who has been working for the group since 1998, said the government should issue rules which protect Emiratis' right to keep their jobs under difficult circumstances, especially since they are the minority in the workforce.

"Emiratis should be protected through legislation during such hard times. We should have these rights as UAE citizens. I find it strange that we should lose jobs in our own country," Ebrahim said.

"There were no legitimate reasons to end my services. I have been working for this company for 11 years and always received good feedback in the annual reviews," said Ebrahim, who also demands compensation on moral grounds as he was asked to leave the same day he received the termination letter.